Free Modified Accelerated Cost Recovery System (MACRS Depreciation)

Modified Accelerated Cost Recovery System (MACRS) depreciation spreadsheet

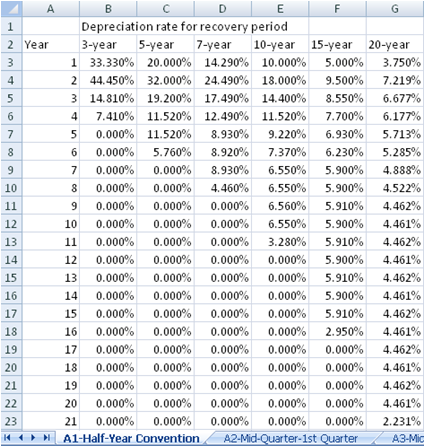

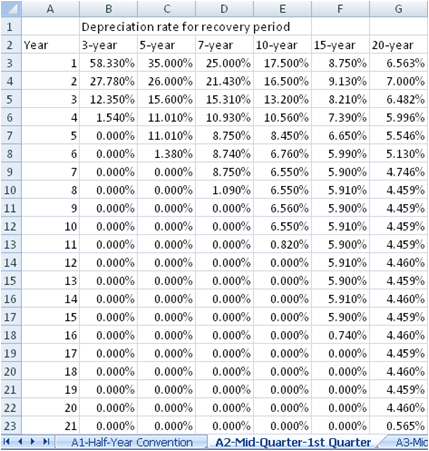

This spreadsheet includes Table A-1 to Table A-9 from the Appendix A of the document "How To Depreciate Property (For use in preparing 2008 Returns)" from United States IRS (https://www.irs.gov). The tables are arranged in a way for ease of use by analysts in financial modeling. Details of each of the table are specified below.Half-Year Convention

Mid-Quarter Convention

Placed in Service in First Quarter

Other Tables

Table A-3. 3-, 5-, 7-, 10-, 15-, and 20-Year Property

Mid-Quarter Convention

Placed in Service in Second Quarter

Table A-4. 3-, 5-, 7-, 10-, 15-, and 20-Year Property

Mid-Quarter Convention

Placed in Service in Third Quarter

Table A-5. 3-, 5-, 7-, 10-, 15-, and 20-Year Property

Mid-Quarter Convention

Placed in Service in Fourth Quarter

Table A-6. Residential Rental Property

Mid-Month Convention

Straight Line-27.5 Years

Table A-7. Nonresidential Real Property

Mid-Month Convention

Straight Line-31.5 Years

Table A-7a. Nonresidential Real Property

Mid-Month Convention

Straight Line-39 Years

Table A-8. Straight Line Method

Half-Year Convention

Table A-9. Straight Line Method

Mid-Quarter Convention

Placed in Service in First Quarter

Download Free Modified Accelerated Cost Recovery System spreadsheet - v1.0

System RequirementsMicrosoft® Windows 7, Windows 8 or Windows 10

Windows Server 2003, 2008, 2012 or 2016

512 MB RAM

5 MB of Hard Disk space

Excel 2007, 2010, 2013 or 2016

License

By downloading this software from our web site, you agree to the terms of our license agreement.

Download

ModifiedAcceleratedCostRecoverySystem_MACRS.zip (Zip Format - 83 KB)