Professional Inflation Calculator

Download Professional

InflationCalculator.zip

License

Commercial License

System Requirements

Microsoft® Windows 7, Windows 8 or Windows 10

Windows Server 2003, 2008, 2012 or 2016

512 MB RAM

5 MB of Hard Disk space

Excel 2007, 2010, 2013 or 2016

Background

When people talk about the effects of their money getting smaller over time, they are talking about the effects of inflation. The question is of course, why our money gets smaller. Economists offer several schools of thoughts. For example, if a country prints more money to solve problems in a time of crisis, the supply of money will go up. This in turn will lead to the money becoming smaller. Another reason could be the production costs of goods and services have gone up, this will also lead to our money being smaller. We know that inflation causes our money to become smaller over time, which is one of the reasons that people put money in the bank to earn interests to counter the effects of inflation.The impact of inflation on financial modeling

In financial modeling, there are typically discussions on the nominal value versus the real value of something. The real value of something basically takes into account the effects of inflation. For example, if you have $1000 today, what is the real value in 5 years time? The real value of the $1000 in 5 years time is to take into account the effects of the yearly inflation. We can use the Time Value of Money concepts to discount the $1000 using the inflation rate over a period of 5 years. This leads us to question what the inflation rate is and how do we calculate the inflation rate?Consumer Price Index

Many countries periodically measure the average price of goods and services purchased by households. This data is in turn published on official government websites. This data allow us to calculate the rate of inflation.Inflation

Inflation is defined as the rise in the general level of prices of goods and services purchased by households. Or in other words, it is a measure of the percent change in the consumer price index (CPI). For example, to measure the inflation in year 2008, we can ue the following formula:(CPI at 2008 - CPI at 2007) / CPI at 2007

Inflation Calculator and Spreadsheet

The U.S. Department Of Labor (Bureau of Labor Statistics) published the Consumer Price Index (CPI) of United States periodically. This data can be used to calculate the inflation rate.Calculating Monthly Inflation

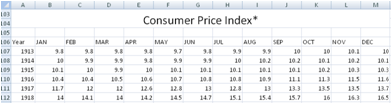

The Inflation Calculator and Spreadsheet (InflationCalculator.xls) provided can be used to calculate the rate of inflation quickly and easily. By default the Inflation&CPI-Monthly worksheet already contains the monthly consumer price index from January 1913 to July 2009. The latest consumer price index can be keyed into the spreadsheet labelled “Consumer Price Index” to calculate the latest inflation.Consumer Price Index input

The website to obtain updated data on consumer price index (CPI) is located at :https://www.bls.gov

Inflation Calculation

The month-to-month inflation is calculated up to 3 decimal points and shown below.

Calculating Yearly Inflation

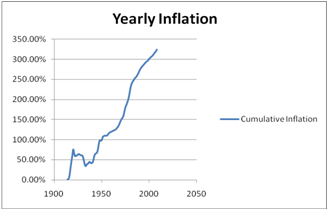

Upon keying in the CPI data in the previous worksheet, the yearly inflation rate will also be automatically calculated in the Inflation-Yearly worksheet. The Inflation-Yearly worksheet uses the average of all the monthly CPI to calculate the yearly inflation. The cumulative inflation is then plotted in a chart as shown on the screen below.

The Fisher Effect

Earlier we have discussed on the nominal value versus the real value of something. The real value of something basically takes into account the effects of inflation. This is useful in financial modeling when we need to calculate the real rate of returns based on the nominal rate of returns. The relationship between the real rate of returns, nominal rate of returns and inflation is commonly known as the Fisher Effect. The formula for the relationship is as shown below:1 + Nominal Rate of Returns = (1 + Real Rate of Returns) * (1 + Inflation Rate)

The FisherEffect worksheet allows us to calculate the Nominal Rate of Returns or Real Rate of Returns based on the formula above. It requires the Inflation Rate from one of the previous worksheet as an input.