Purchasing Power Parity

The Law of One Price

The Law of One Price states that in an efficient market where there is free flow of goods, services and capital a commodity has only one price regardless of the country in which it is purchased. The idea behind the Law of One Price is that if a commodity costs more in one country than the other, arbitrage will be possible by moving the commodity from the country with lower price to the one with the higher price.Purchasing Power Parity

The Purchasing Power Parity is based on the Law of One Price. It states that exchange rate will adjust so that a commodity will cost the same regardless of the country in which it is purchased in.Relative Purchasing Power Parity

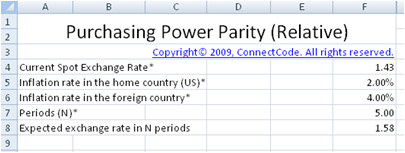

Relative Purchasing Power Parity further evolved from the concept of Purchasing Power Parity. Basically it relates the concept of Purchasing Power Parity with the concept of inflation. It states that the inflation in one country over the inflation of the other country determines the exchange rate between these two countries.Relative Purchasing Power Parity spreadsheet

Based on the Relative Purchasing Power Parity, the expected exchange rate in the future is calculated as follows:Expected exchange rate in the future = Current Spot Exchange Rate * ((1 + (Inflation of Foreign County - Inflation of Home Country)) ^ Number of Periods)

In the spreadsheet, the following formula is used to calculate the Expected exchange rate in N periods.

=F4*((1+(F6-F5))^F7)

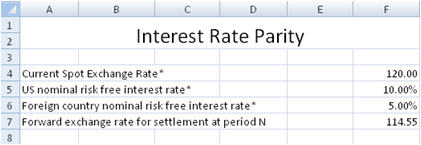

Interest Rate Parity

The Interest Rate Parity states that the interest rate difference between two countries is equal to the percentage difference between the forward exchange rate and the spot exchange rate. The formula for the Interest Rate Parity is shown below. This is also the formula used by the InterestRateParity worksheet.Forward exchange rate for settlement at period N = Current Spot Exchange Rate * ((1+Foreign country nominal risk free interest rate)/(1+US nominal risk free interest rate))

Interest Rate Parity spreadsheet

An approximation of the exchange rate which supports N periods is calculated in the InterestRateParityApproximation worksheet. The formula used is as below :

Forward exchange rate for settlement at period N = Current Spot Exchange Rate*((1+(Foreign country nominal risk free interest rate-US nominal risk free interest rate)) ^ Number of Periods)

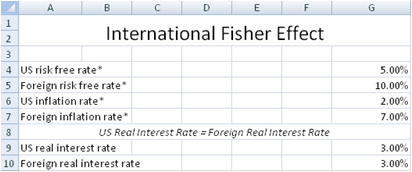

International Fisher Effect

Both the Interest Rate Parity theory and the Purchasing Power Parity theory allows us to estimate the future expected exchange rate. The Interest Rate Parity theory relates exchange rate with risk free interest rates while the Purchasing Power Parity theory relates exchange rate with inflation rates. Putting them together basically tell us that risk free interest rates are related to inflation rates. This brings us to the International Fisher Effect. The International Fisher Effect states that the real interest rates are equal across countries. Real interest rates are approximately the risk free rate minus the inflation rate.International Fisher Effect spreadsheet

The InternationalFisherEffect table worksheets simply approximate the real interest rates of a foreign country compared to US.

Download Free International Fisher Effect Calculator - v1.0

System RequirementsMicrosoft® Windows 7, Windows 8 or Windows 10

Windows Server 2003, 2008, 2012 or 2016

512 MB RAM

5 MB of Hard Disk space

Excel 2007, 2010, 2013 or 2016

License

By downloading this software from our web site, you agree to the terms of our license agreement.

Download

FreeInternationalFisherEffect.zip (Zip Format - 89 KB)

Get the Professional version

Benefits- Unlocked

- Allows removal of copyright message in the template

- Allows commercial use within the company

- Allows customization of the International Fisher Effect calculator

Download Professional

InternationalFisherEffect.zip