Jensen's Alpha

Jensen's Alpha is also known as the Jensen's Performance Index. It was first used in the 1970s by Michael Jensen to evaluate the performance of fund managers. Specifically, it is measuring the difference between the actual returns of a portfolio during a period and the expected returns of the portfolio using the Capital Asset Pricing Model (CAPM). The formula for Jensen's Alpha is as shown below:Jensen's alpha = Portfolio Return-(Risk Free Rate+Portfolio Beta*(Market Return-Risk Free Rate))

This performance index is now widely used by the public for measuring the performance of investment or fund manager. The formula can be thought of as calculating the excess returns a fund manager has made over the broader market. An example of a broader market is the S&P 500 composite. A positive value indicates good securities picking skills of a fund manager. If you are comparing the Jensen's Alpha of similar portfolios by different fund managers, then the bigger the Jensen's Alpha indicates a better performance of the fund.

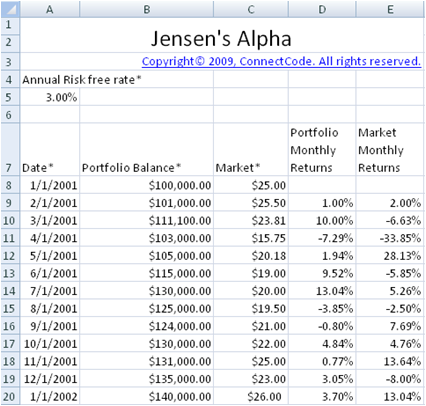

Jensen's Alpha Spreadsheet

This spreadsheet provides a basic template for calculating the Jensen's Alpha. It uses monthly data of the portfolio and the broader market over a period of 1 year for the calculation. This can be easily expanded to 3-5 years period commonly seen in investment reports.

Output

The Variance of the Portfolio and the Market is first calculated followed by the Covariance of the Portfolio with respect to the broader market. The S&P 500 composite data can be used in calculating the Jensen's Alpha of a U.S portfolio. The Variance and Covariance are then used in the calculation of the Portfolio's Beta. This Beta is used for calculating the Expected Return of the Portfolio using CAPM.

The calculation of the monthly Risk Free rate is as shown below.

Monthly Risk Free Rate = ((1+Annual Risk Free Rate)^(1/12)-1)

Download Free Jensen Alpha spreadsheet - v1.0

System RequirementsMicrosoft® Windows 7, Windows 8 or Windows 10

Windows Server 2003, 2008, 2012 or 2016

512 MB RAM

5 MB of Hard Disk space

Excel 2007, 2010, 2013 or 2016

License

By downloading this software from our web site, you agree to the terms of our license agreement.

Download

FreeJensenAlpha.zip (Zip Format - 90 KB)

Get the Professional version

Benefits- Unlocked

- Allows removal of copyright message in the template

- Allows commercial use within the company

- Allows customization of the model

- Expand Jensen's Alpha calculation to 36 months, 48 months, 60 months or any other long term period

- Full source code

- Portfolio Risk, Sharpe Ratio and Treynor Index

Price

Download Professional

JensenAlpha.zip