Free Capital Budgeting Spreadsheet

Capital Budgeting

Capital Budgeting is the process of analyzing a company's investment decisions such as investing in new equipments, machineries, plants, projects and products. This process involves the estimation of the expected cash flows, the calculation of the Net Present Value (NPV) and the calculation of the Internal Rate of Return (IRR) of the investment. Net Present Value is defined as the present value of all cash inflows minus the present value of all cash outflows. If NPV is positive, the investment is making money and is thus viable. Internal Rate of Return is defined as the discount rate that makes the Net Present Value zero. If the IRR is greater than the opportunity cost of capital then the investment is feasible. The greater the value the IRR, the more feasible an investment is.There are two hurdles in this analyzing process. One involves the correct estimation of the expected cash flow. The other is the use of a correct discount rate (also known as the Project Cost of Capital). In some cases, it is possible to simply use the Company' Weighted Average Cost of Capital (WACC) as the Project Cost of Capital. This is especially the case if the project has similar cost structure as the company. In other cases, a separate estimation or assumption of the Project Cost of Capital is required.

This Capital Budgeting spreadsheet aims to assist investors, managers or analysts in correctly estimating the cash flow in different scenarios and accurately calculating the Net Present Value and Internal Rate of Return. It also allows different investment projects cash flow to be compared and the forecasting of base case, worst case and best case scenario.

Calculating the NPV and IRR of a Project Investment

The CapitalBudgeting-ProjectCashFlow-NPV worksheet in the Capital Budgeting spreadsheet allows you to key in the assumptions and estimates of a project cash flow and will calculate the Net Present Value and Internal Rate of Return of the investment.Assumptions

This worksheet performs capital budgeting analysis by making three basic assumptions. The assumptions are the Discount Rate to use in the investment project, the company's Tax Rate and the estimated percentage of Net Working Capital over Sales.

Projected Income

The net income of the project is calculated by using the following formula:

Net income = Earnings before Interest & Taxes (EBIT) - Taxes

where

EBIT = Net Sales - Total Variable Costs - Total Fixed Costs - Depreciation

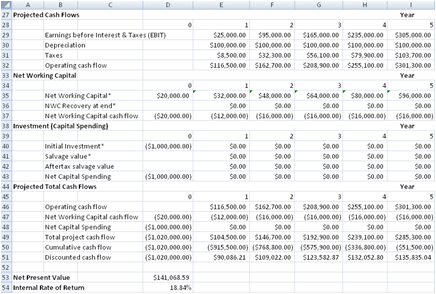

Projected Cash Flows

This section is where the estimated cash flows are calculated. The Operating cash flow is defined as follows:

Operating cash flow = EBIT + Depreaciation + Taxes

Net Working Capital

The Net Working Capital at Year 0 can be entered directly into the spreadsheet. From Year 1 onwards, it is calculated as as function over Net Sales as follows:

Net Working Capital = Net Working Capital over Sales * Net Sales

Net Working Capital cash flow is calculated as follows:

Net Working Capital cash flow = -(Current Year Net Working Capital - Previous Year Net Working Capital) + NWC Recovery at end

Investment (Capital Spending)

The project investment and salvage value are taken into account in this section.

Aftertax salvage value is calculated as follows:

Aftertax salvage value = Salvage value * (1 - Tax Rate)

Net Capital Spending is calculated as follows:

Net Capital Spending = Initial Investment + Aftertax salvage value

Project Total Cash Flow

The Discounted cash flow uses the Time Value of Money to discount the Total project cash flow with the assumed Discount Rate. Total project cash flow is calculated as follows:

Total project cash flow = Operating cash flow + Net Working Capital cash flow + Net Capital Spending

Net Present Value and Internal Rate of Return

Net Present Value is calculated using Excel's NPV function on the Total project cash flow. Internal Rate of Return is calculated using Excel's IRR function on the Total project cash flow.

Download Free Capital Budgeting spreadsheet - v1.0

System RequirementsMicrosoft® Windows 7, Windows 8 or Windows 10

Windows Server 2003, 2008, 2012 or 2016

512 MB RAM

5 MB of Hard Disk space

Excel 2007, 2010, 2013 or 2016

License

By downloading this software from our web site, you agree to the terms of our license agreement.

Download

FreeCapitalBudgeting.zip (Zip Format - 95 KB)

Get the Professional version

Benefits- Unlocked

- Allows removal of copyright message in the template

- Allows commercial use within the company

- Allows full customization of the model

- Additional Worksheet for estimating Cash Flow before and after a Project Investment

- Additional Worksheet for Scenario Analysis. Forecast for Base Case, Worst Case and Best Case

Bonus

- Includes the Professional Inflation and Consumer Price Index Calculator Spreadsheet

- Includes the Professional Weighted Average Cost of Capital (WACC) Calculator Spreadsheet

USD69.00 - Purchase