- TinyGraphs

- SparkCode Professional

- Duplicate Remover

- ConnectCode Deluxe Add-In

- ConnectCode Barcode Font Pack

- ConnectCode Number Manager

- ConnectCode Text Manager

- TraderCode Technical Indicators

- Neural Networks Trading

- Financial Modeling - Free Investment and Financial Calculator

Free Investment and Financial Calculator (TVM, NPV, IRR)

The Time Value of Money and Discounted Cash Flow Analysis are two cornerstone concepts of investment and financial analysis. The aim of this free investment/financial calculator and tutorial is to introduce these two concepts and at the same time use Microsoft Excel to develop financial models that utilize these concepts for analyzing investments.It is known that most financial analysts in the industry developed their own set of models during their course of work over the years. The models usually form the basis of their analysis work and become an extremely important toolkit to them. This tutorial aims to provide the basis of building this toolkit and serve as a stepping stone for financial analysts to building more complex models. The concepts listed will be supported by the calculator.

Time Value of Money (TVM)

- Future Value of a Lump Sum

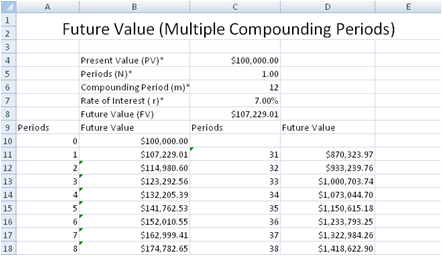

- Future Value of a Lump Sum with more than 1 compounding period per year

- Future Value of a Lump Sum with Continuous Compounding

- Future Value of an Ordinary Annuity

- Future Value of a series of unequal cash flow

- Present Value of a Lump Sum to be received in the Future

- Present Value of a Lump Sum with more than 1 compounding period per year

- Present Value of an Ordinary Annuity

- Present Value of a Perpetuity

- Present Value of a series of unequal cash flow

Discounted Cash Flow Analysis (DCF)

- Net Present Value (NPV)

- Internal Rate of Return (IRR)

- Money Weighted Rate of Return

- Time Weighted Rate of Return

- Holding Period Return

- Bank Discount Yield

- Money Market Yield

Background

If given a choice of $1000 to be received today or two years later, most people will no doubt choose to receive the money today. The reason is very simple, the $1000 received today can be put in the banks or in risk free instruments like the US Treasury Bills to earn interest. In two years’ time, the $1000 with interest will be worth more than the $1000 today. This simple concept forms the basis of the Time Value of Money.If given a choice of receiving $1000 today or $1050 two years later, what would you choose? This is slightly more difficult. We will need to compare these two values on a fair and comparable basis. For example, what is $1000 worth two years later or what is the $1050 in two years’ time worth today? In other words, we are asking what the future value of the $1000 is in two years’ time or what the present value of the $1050 is now.

Download Investment and Financial Calculator - v1.3

Download the Investment and Financial Calculator for Excel

System Requirements

- Microsoft® Windows 7, Windows 8 or Windows 10

- Windows Server 2003, 2008, 2012 or 2016

- 512 MB RAM

- 5 MB of Hard Disk space

- Excel 2007, Excel 2010, Excel 2013 or Excel 2016

FreeInvestmentFinancialCalculator.zip (Zip Format - 352 KB)

Back to Add-Ins and Templates for Excel main page.