Unlevered Beta Spreadsheet

The Beta is a measure of the risk of a company. In general, when considering the risks of a company, we can categorize them into financial and business risks. The business risk relates to the risk of running the business while financial risk relates to the risk of borrowing money for running the business. Sometimes, it is useful to just compare the business risk of the different companies without the effects of the financial risk. Or in other words, compare risks without the effects of leverage.Unlevering a Beta allows us to remove the financial risk or effects of leverage, i.e. to consider the risk of a company assuming it has zero debt.

Unlevered Beta Worksheet

This worksheet shows us how to calculate the Unlevered Beta from the company's Beta.

- Tax Rate(T)* - The Tax Rate of the company.

- Levered Beta (B)* - The company's leverage Beta, also known as the Stock Beta.

- Debt to Equity Ratio (DER)* - The company's debt to equity ratio.

-

Unlevered Beta - The Unlevered Beta is calculated as follows:

Unlevered Beta = Levered Beta * (1 / (1 + (1 - Tax Rate) * Debt to Equity Ratio))

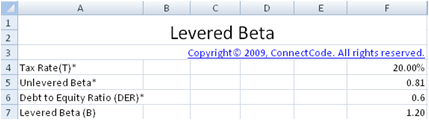

Levered Beta Worksheet

The Levered Beta can be calculated from the Unlevered Beta through the following worksheet

- Tax Rate(T)* - The Tax Rate of the company.

- Unlevered Beta* - The company's beta without the effects of leverage.

- Debt to Equity Ratio (DER)* - The company's debt to equity ratio.

-

Levered Beta (B) - The Levered Beta is calculated as follows:

Levered Beta = Unlevered Beta * (1+ ((1-Tax Rate)*Debt to Equity Ratio))

System Requirements

Microsoft® Windows 7, Windows 8 or Windows 10

Windows Server 2008, 2012 or 2016

512 MB RAM

5 MB of Hard Disk space

Excel 2007, 2010, 2013, 2016

PDF Specifications

Back to Free Stock Beta Spreadsheet.